The success of the actions taken depend on making the right decisions at the right time. For this, the management needs current and future key figures of the portfolio in the entire product cycle. RealEstimate® fulfils these requirements with special options for key figure formation, quantitative SWOT analysis and other effective analysis options at company, product and object level.

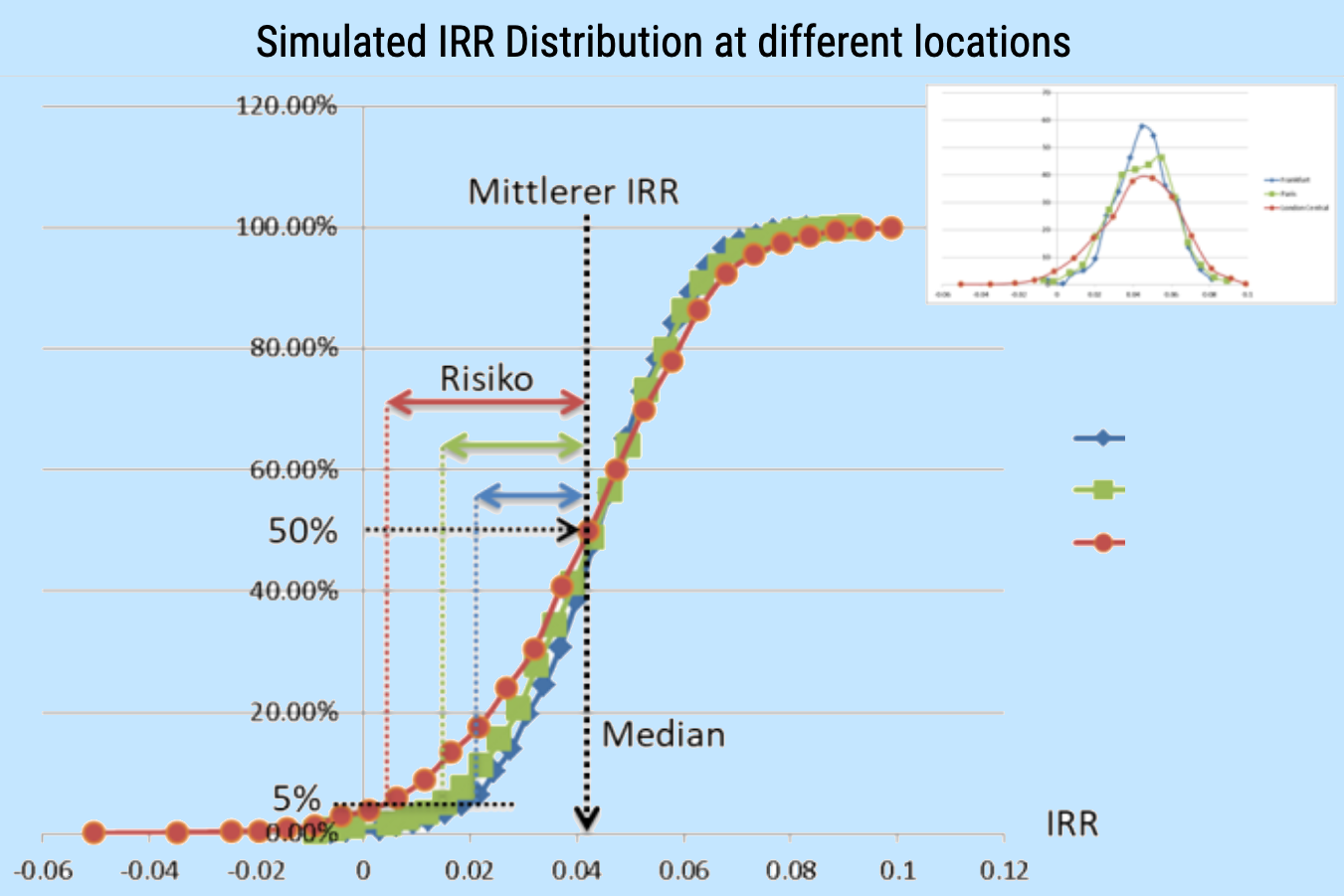

Value at Risk and other risk analyses such as stress tests and sensitivities have become indispensable in the risk management of stock portfolios. RealEstimate® combines established standard procedures of evaluation and risk analysis with innovative financial mathematical models. RealEstimate® thus creates a basis for meeting regulatory requirements.

An essential component of a modern risk and portfolio management system is the reporting concept. RealEstimate® offers addressee-oriented reporting, whereby all reports and analyses can be combined with each other in an interdisciplinary manner. Thus, the addressees receive exactly the information they need.